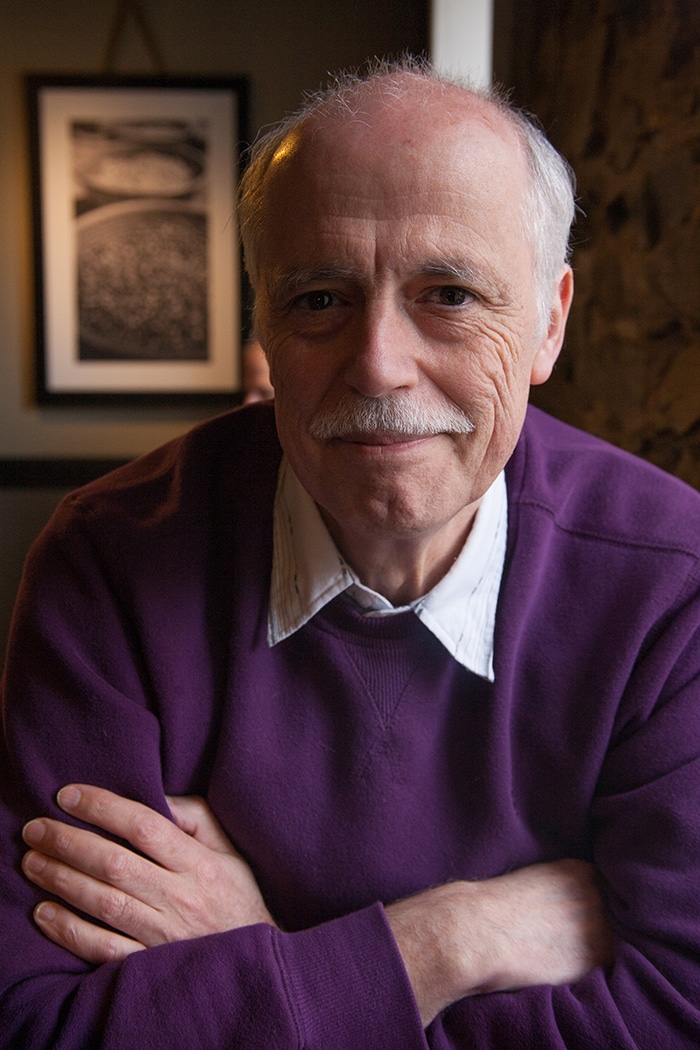

In our latest Healthspan Expert Q & A, we talk with Dana Goldman, Ph.D., professor and Leonard D. Schaeffer Chair and Director of the USC Schaeffer Center for Health Policy & Economics, about aging demographics in the U.S. Please note Dr. Goldman’s opinions are his own.

Q: Please give us a background into your interest into the aging of the U.S. population?

DG: Ironically, I first became interested in aging when I was studying obesity in younger populations. We all know obesity is a public health problem, and we were studying the value of interventions to reduce weight at earlier ages. However, it soon became clear that such interventions are not well-targeted and hence can be very expensive. We started to look at prevention at older ages, and what we found was that interventions at older ages often yielded greater social returns. For example, when you improve hypertension control in older populations, you may not have as long a lifetime to see the benefits as obesity in younger populations. However, the older populations are at much higher risk, and the returns are more immediate. The bottom line from this work was that prevention in the elderly is often a great deal for society, even at older ages, and can even yield higher returns than interventions at earlier ages.

Q: What is the Future Elderly Model?

DG: The Future Elderly Model is a simulation designed to answer some basic questions about the benefits—and costs—of better health. Unlike many other models, it takes a very broad view beyond just looking at health conditions and medical spending. Rather, we examine the consequences of interventions on productivity, government costs, and functional status. It was originally developed with support from the Centers for Medicare & Medicaid Services (CMS), which wanted to know how public health trends and future medical technologies would affect outcomes for the elderly going forward. Since that time, the model has been adapted to study a wide array of broad policy questions, such as what would happen if we reduced smoking in the elderly or what the benefits of new cancer treatments are. We even studied what would happen if older Americans were as healthy as their Western European counterparts!

Q: In your article in Health Affairs, you talked about the long-term benefits of delaying aging. Are you still optimistic about this assessment? And if so, why?

DG: I am quite optimistic. Once we do a good job valuing the health gains both in terms of life expectancy and quality of life, the benefits of successfully delaying aging outweigh the costs by a factor of 10 or more. This does not mean that delayed aging will pay for itself in reduced health care spending, quite the contrary. However, it is a very different question to ask if the medical spending is less or more than to ask if the benefits outweigh the costs. That is because the benefits include all the value we place on healthier, longer life. For example, we find that if the promise of delayed aging is fully realized—based on the best animal models—we could increase life expectancy by an additional 2.2 years, most of which would be spent in good health. The economic value would be about $7.1 trillion over 50 years—with little additional government costs if we index Medicare and Social Security to the life expectancy increases. The trick, of course, is to do this successfully.

Q: As an economist, what is your present view of the U.S. economic situation as it relates to the older adult population?

DG: On the one hand, we hear about remarkable success stories of people living long, productive lives well into their 80s and 90s. On the other hand, we also hear about elderly people who reach retirement age with severe disability, no savings, and a very tenuous safety net. The reality is that both stories are true. There is remarkable heterogeneity in the aging population—almost as if there are two Americas. White males with a college degree have a life expectancy more than 14 years longer than black Americans with fewer than 12 years of education—and the gap is widening. These differences put enormous tension in the social fabric, and our institutions are not adapting quickly enough. Imagine if someone does discover a pill that delayed aging, for example. It would be enormously valuable to society (and probably pretty expensive too). Medicare and other insurers would likely try to limit access, arguing that this drug is really not a medical treatment since healthy people would take it. Hence, it would not covered, and only a select few would get access. This will exacerbate the disparities even more.

Q: Are there any changes that need to be made in current health and/or entitlement programs that will help ensure that the economy can adapt to this changing demographic?

DG: There are so many policies and social institutions that are ill-adapted to changing demographics. We clearly need to strengthen the safety net, but not at the expense of encouraging people to work and be productive at older ages. Social Security’s retirement program is the first place to start. These benefits were first introduced in 1935 as a financial safety net for a rapidly growing population of destitute older Americans. While Social Security is meant to be economically self-sustaining, rising life expectancies continually threaten its solvency. It is clear that the age of eligibility will need to rise and should probably be indexed to general life expectancy trends. The challenge, of course, is that extending the age of eligibility places more burden on the sick and the disabled, so we need to also strengthen that part of the safety net.

Medicare is also ripe for reform. The fiscal solvency of the United States is tied very closely to the path of this program, and we just are not getting a lot of value for the money. Medicare needs to stop paying for wasteful services and to better reward interventions (and health systems) that achieve better health. This is not an ideological issue, either; there are both public and private solutions that could do so. At the regulatory level, the U.S. Food and Drug Administration has to figure out how to deal with interventions that might be given when people are healthy to prevent cognitive decline, muscle loss, and general functional decline—and then CMS has to figure out how to pay for them.

Q: Finally, are there any projects/initiatives in relation to aging that you’d like to share with us?

DG: At the Schaeffer Center for Health Policy & Economics, we are hard at work on a lot of these issues. We are conducting research and policy efforts to identify how we can use the tools of behavioral economics, precision medicine, and better care delivery models to improve health and get more value for our money, even among hard-to-reach populations. We are also examining how biomedical innovation—when regulated and rewarded properly—can help.