Saving for retirement is a major priority for many Americans. In addition to our Social Security, many of us are socking away savings in anticipation of that day when we finally retire from the workplace.

However, many of us might not be anticipating the potential costs of health care in our retirement years.

Health care expenditures in the U.S. currently exceed $3.5 trillion. And they are expected to grow by an average of 5.6 percent annually through 2025. This makes preparing for these costs even more important.

Unfortunately, many Americans are not ready, according to a new brief released in partnership with the Alliance and the United Health Foundation called Preparing for Health Care Costs in Retirement.

According to the report, 50 percent of those ages 65 and over don’t know or have no opinion about how much money they will need to cover health care costs during retirement.

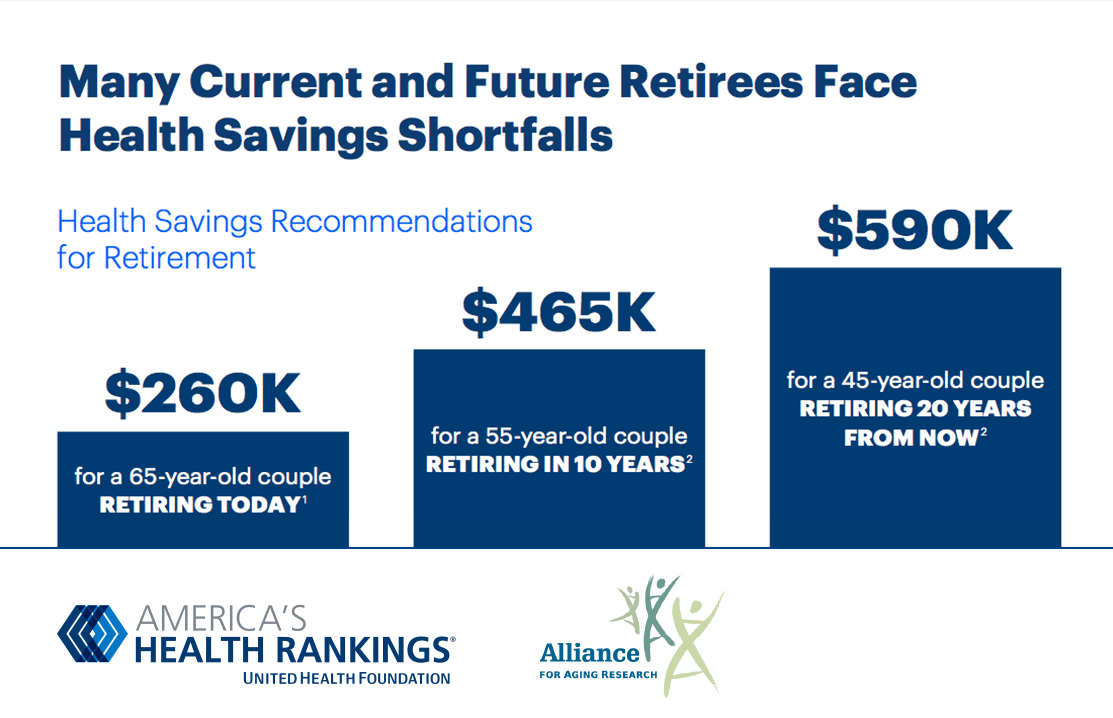

And it isn’t cheap, as this chart shows.

Even worse, 62 percent of retirees ages 65 and over and nearly three out of four non-retired adults ages 50 to 64 have less in total retirement savings than what experts recommend saving for health care costs alone.

So what can you do? First, take an account of where you are at and what you need to do to get there. Then take action now to plan for retirement.

AARP has resources to help you plan, including a retirement calculator.